Secure Your Loved Ones’ Future with Our Personalized Life Insurance

Do you worry about leaving your loved ones burdened with expenses if something were to happen to you?

Ensure their financial stability with Life Insurance and ACE Venture.

🙃 Jiyo Secured & Fikar-Free

We understand the importance of securing your loved ones’ future. With our comprehensive range of life insurance plans, we aim to provide you with peace of mind knowing that your family’s financial well-being is protected, no matter what life may bring.

Click 2 Protect Super

- Comprehensive protection customizable to your needs.

- Flexibility to choose from multiple coverage options.

- Life stage option to increase your cover on marriage or childbirth.

Sanchay Par Advantage

- Whole life cover with lifelong income.

- Deferred income option with guaranteed benefits.

- Tax benefits to maximize your savings.

Find a Best Plan for Me

HDFC Life Click 2 Achieve

- Life insurance cover for the financial security of your family.

- Guaranteed benefits to ensure peace of mind.

- Flexibility in choosing benefits, with options increasing up to 10% annually.

HDFC Life Smart Protect Plan

- Loyalty additions to enhance your benefits over time.

- Options for level or decreasing cover plans.

- Capital guarantee plan option for added security.

Are Your Spending Habits Holding You Back?

Over spending on non-essential items

Impulse purchases adding up over time

Ignoring budgeting and financial planning

Breaking the Cycle of Irresponsibility

Recognize unnecessary expenses

Set financial goals for the future

Prioritize saving and investing for long-term stability

Secure Your Future Financial Freedom with Life Insurance

Build an emergency fund for unexpected expenses

Start investing early for long-term growth

Avoid falling into the trap of debt and financial stress

Incorporating life insurance into your financial plan can provide an additional layer of security, ensuring that your 🤗 loved ones are 🔒protected in case of unforeseen circumstances.

ACE Venture is well known for making you to achieve greater financial stability and retire early.

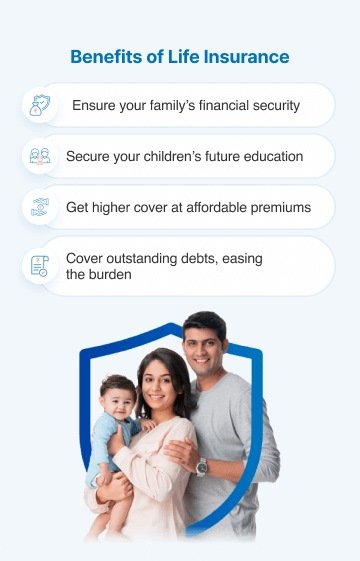

Why should you consider buying Life Insurance?

Financial security for your family & loved ones

A life insurance plan can help your family live comfortably and worry-free by replacing your income in case of mis-happening. It assists them in maintaining their way of life and paying for bills like food, rent, schooling, etc.

To pay for your children's future education

If the family's primary provider dies, the cost of their education may become extremely burdensome. Even if you are not living, life insurance makes sure your kids attend the college of their choice.

To save for retirement and make plans for future

Unexpected occurrences such as illness and disability can cause financial ruin for your family. It functions as a safety net and pays for expenses in unanticipated situations.

To settle any debts you may owe

Your family may have financial hardships following your death as a result of your debts. Life insurance provides financial freedom to your family members by assisting them in paying off debts such as credit card bills and house loans.

To qualify for tax deductions under the Income Tax Act

Under section 80C of the Income Tax Act, you can benefit from tax deductions of up to Rs 1.5 lakhs annually with the premiums you pay. You can also avail section 80d the premiums you pay for add-on riders.

For financial security and peace of mind

Life insurance can provide you with a sense of calm by ensuring that your family is secure financially and does not need to worry about your debts. You can then live a confident and stress-free life.

Who Should Take Life Insurance?

Life insurance is essential for anyone who wants to ensure the financial security of their loved ones in the event of their untimely demise.

Breadwinners

Individuals who provide the primary source of income for their family.

Parents

Those responsible for the well-being and education of their children.

Newlyweds

Couples starting their lives together and planning for their future.

Business Owners

Entrepreneurs seeking to protect their business assets and interests.

Individuals with Financial Liabilities

Protect your family from your debts and provides financial support for dependents

People about to get retired

Take extra income during retirement, financial security in your golden years.

Milind Pandit

Plan your financial future as per your unique personality

Choose a plan that best suits your future goals

What people say about Us and Life Insurance?

Our guarantee

At ACE VENTURE, we guarantee safety, trust, and credibility with all our Life Insurance plans. Rest assured, your financial future is secure with us. With our commitment to transparency and reliability, we ensure your peace of mind. Additionally, our dedicated team of experts is always available to provide personalized guidance and support, ensuring you make informed decisions tailored to your unique needs. Choose ACE VENTURE for comprehensive coverage and trusted service, providing you with the assurance you need for your loved ones’ future.

Ready to take the first step towards securing your family's future?

- Worried about the impact on your family if something were to happen to you?

- Uncertain About the Future?

- Concerned about how your family will afford healthcare in case of an emergency?

- Do you feel anxious about the uncertainties of life?

- Are you drowning in debt and worried about your family's financial future?

🛡️ Secure your family’s future today with life insurance. Don’t let uncertainty and worry hold you back from giving them the protection and stability they deserve.

Take the first step towards peace of mind by investing in life insurance today. 😊

Har Waqt Ke Liye Taiyaar !!

Frequently Asked Questions

Life insurance is a financial product that provides a lump sum payment to your beneficiaries upon your death. It is essential for anyone who wants to ensure their loved ones’ financial security and protect them from the impact of unforeseen circumstances.

The amount of coverage you need depends on various factors, including your income, debts, lifestyle, and the financial needs of your dependents. A general rule of thumb is to aim for coverage that is at least 10-15 times your annual income.

The cost of life insurance depends on various factors, including your age, health, lifestyle, coverage amount, and type of policy. Generally, term life insurance tends to be more affordable than whole life or universal life insurance.

Yes, many life insurance policies offer flexibility and allow you to adjust your coverage over time. However, any changes may be subject to underwriting approval and could affect your premiums.

If you miss a premium payment, most life insurance policies have a grace period during which you can still make the payment without any penalties. However, if you fail to make the payment within the grace period, your policy may lapse, and your coverage could be terminated.

Yes, it is possible to have multiple life insurance policies. Having multiple policies can provide additional coverage and flexibility, but it’s essential to consider your overall financial situation and ensure that you can afford the premiums for all policies.

To file a claim on a life insurance policy, you typically need to contact the insurance company and provide them with the necessary documentation, such as a death certificate and policy information. The insurance company will then review the claim and process the payout to your beneficiaries.